You can file ITR electronically and verify it using digital signatures.

The password to open the statement will be your PAN Number (in CAPITAL) followed by your Date of Birth (DDMMYYYY) without any space or sign. Download ITR-5 Online How to File ITR-5 Form Online Taxpayer entities which are eligible to file ITR-3 form can file duly filled form online at the e-filing portal of the Income Tax Department. The statements may be downloaded in PDF or JPEG format. unless you download and install the latest version of Adobe Reader. You may download both TIS and AIS as both contain the same information, but in summary form in TIS and in details in AIS. Forms for collecting and reporting Texas sales and use tax.

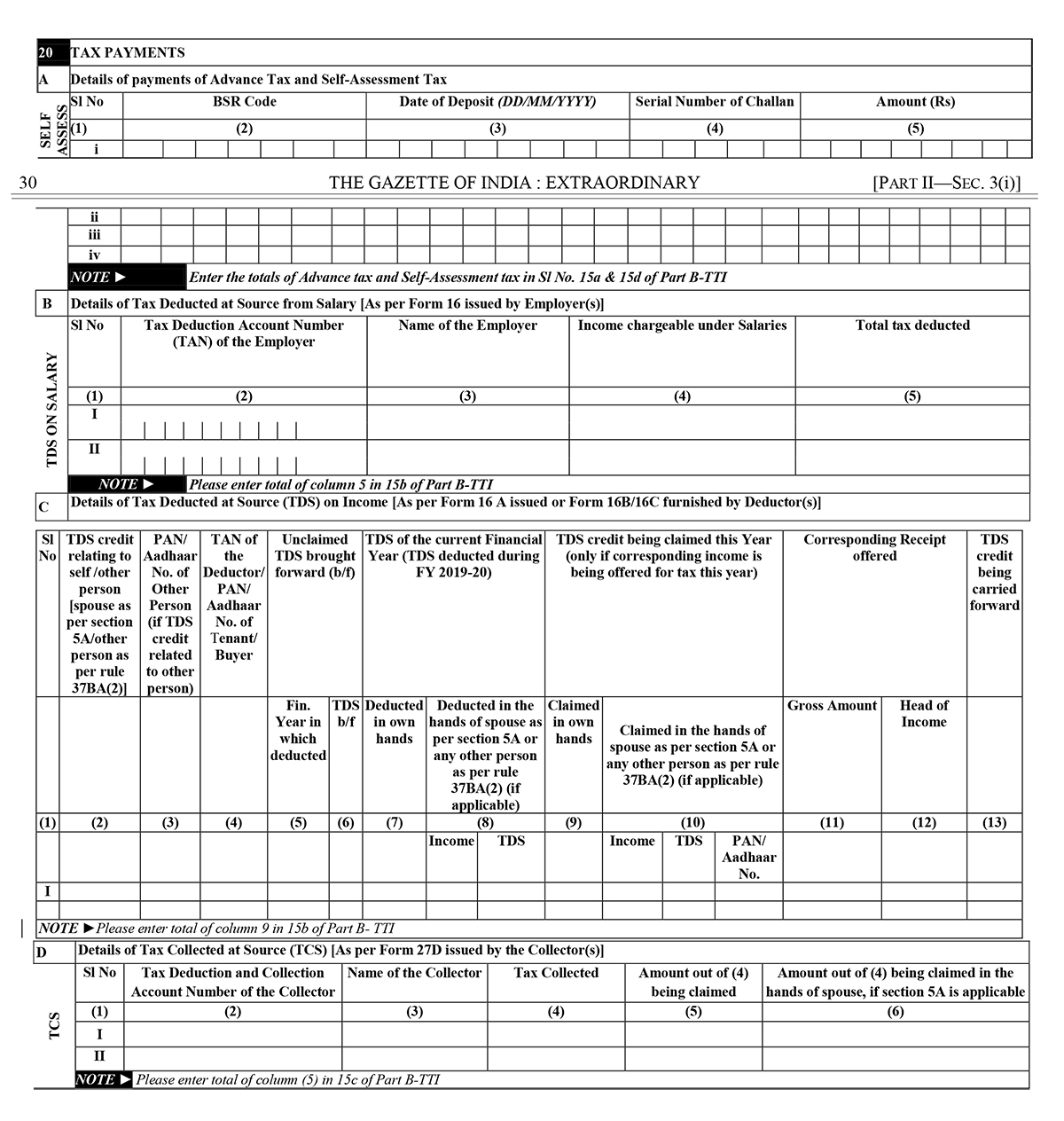

So, you will find it very easy to know and submit details for your ITR. So, after the introduction of AIS, Form 26AS will lose its relevance to an extent.Īnnual Information Statement vs Form 26AS: Now get more information at one place to file ITRįor now, it will not be stopped and a taxpayer can access both Form 26AS and AIS simultaneously. To overcome the problem and to make filing of return of income easier for the taxpayers, the Annual Information Statement (AIS) has been introduced, which aims to contain almost all the information needed to file an ITR. 2009-10/ Financial Year 2008-09 To download you must subscribe. Notification for the same can be found at the following Link:- CBDT notified Income Tax Return Forms (ITR) for A.Y. Nil tax even for income a tad above Rs 7 lakh Please not that ITR for online filing can be downloaded from the Income Tax department Site.

0 kommentar(er)

0 kommentar(er)